WHAT WE DO

WHAT WE DO

Our core focus is to bridge the gap between investors and bankable, scalable, and highly impactful investment opportunities with the appropriate risk-adjusted returns in emerging and developing markets. We do that by delivering on three main areas of business.

INVESTMENT ADVISORY

CAPITAL RAISING

By having a deep understanding of our clients’ capital needs, we offer a range of tailored end-to-end capital raising services.

Our Capital raising services are to match the needs of investees who are seeking to raise capital to finance their growth and generate both financial returns and positive impact, including:

STRATEGIC INITATIVES & INVESTMENT PROMOTION

Catalytic Initiatives

Through ACIP’s Catalyst Initiatives, we develop transformative sectoral and geographic-focused initiatives to enhance the overall risk profile of a particular sector(s). Our initiatives combine:

- Origination of bankable and scalable deal-flow of size;

- Tailoring of local currency financing solutions to match and address the demand of the local market;

- Risk mitigation solutions that would allow for a higher flow of capital; and

- Solutions to unlock the flow of private funding into viable investment opportunities.

ACIP Syndicate

ACIP Syndicate aims to connect institutional investors such as pension funds, insurance companies, and sovereign wealth funds into bankable investment opportunities in emerging and frontier markets.

We advise investors on the design of innovative co-investment vehicles and syndication models that can offer them sustainable investment opportunities with attractive risk-adjusted returns in the next frontiers of growth.

We also have extensive experience in blended finance structuring for the mobilization of private capital into developing countries.

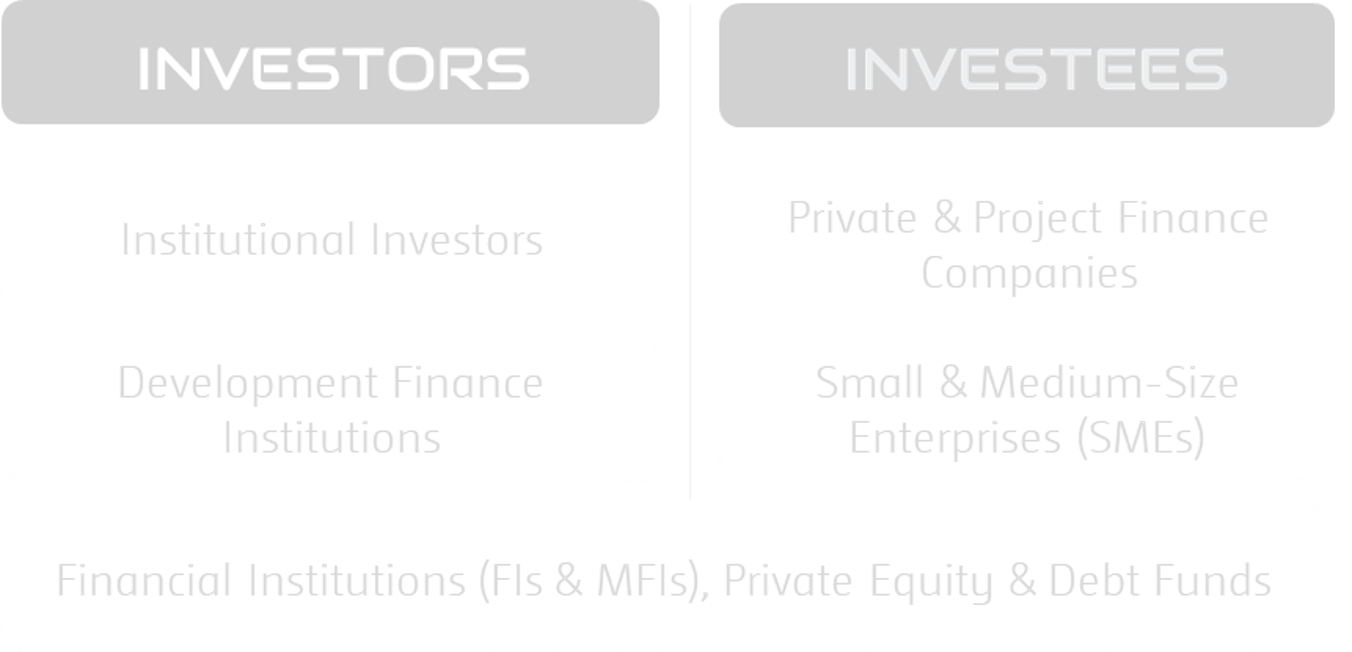

THE RANGE OF INSTITUTIONS WE COVER

ACIP

WHAT WE DO

Our core focus is to bridge the gap between investors and bankable, scalable, and highly impactful investment opportunities with the appropriate risk-adjusted returns in emerging and developing markets. We do that by delivering on three key areas of business.

INVESTMENT ADVISORY

Following a rigorous and disciplined investment and appraisal process, we provide tailored investment advisory services to:

Our investment advisory services include:

CAPITAL RAISING

By having a deep understanding of our clients’ capital needs, we offer a range of tailored end-to-end capital raising services.

Our Capital raising services are to match the needs of investees who are seeking to raise capital to finance their growth and generate both financial returns and positive impact, including:

We support our clients throughout the capital raising process, including:

STRATEGIC INITATIVES & INVESTMENT PROMOTION

Catalytic Initiatives

- 1 Origination of bankable, and scalable deal-flow of size;

- 2 Tailoring of local currency financing solutions to match and address the demand of the local market;

- 3 Risk mitigation solutions that would allow for a higher flow of capital; and

- 4 Solutions to unlock the flow of private funding into viable investment opportunities.

ACIP Syndicate

ACIP Syndicate aims to connect institutional investors such as pension funds, insurance companies and sovereign wealth funds into bankable investment opportunities in emerging and frontier markets.

We advise investors on the design of innovative co-investment vehicles and syndication models that can offer them sustainable investment opportunities with attractive risk-adjusted returns in the next frontiers of growth.

We also have extensive experience in blended finance structuring for the mobilization of private capital into developing countries.